Return

Microservices Architecture in Financial Systems: Benefits, Challenges, and Use Cases

Post date :

Oct 12, 2023

How and why Finbox's white-label solution for investing has been moved to microservices from a monolith.

In a bid to streamline operations, boost staff productivity, and heighten client contentment, numerous banks across the globe have embraced digital transformation. Utilizing advanced software solutions, these institutions are offering users the ability to establish bank accounts, conduct transactions, manage bill payments, oversee payment processes, and generate and authenticate documents with ease.

Yet, retaining customers requires more than just digital services; it’s essential to guarantee the continuous availability, scalability, and efficiency of these software systems. To stay ahead in the competitive landscape, organizations must also be agile in rolling out new applications and innovative features. This transformation is closely related to the tech stack and modern standards in cyber security and regulations.

We can observe neobanks like Revolut, N26, Nubank, and Mizuho utilizing microservices architecture to maintain a competitive edge.

What is microservices architecture?

Microservices architecture is a style of software architecture that breaks down an application into a set of small, independent services, each running in its own process and communicating through well-defined APIs. These services can be developed, deployed, and scaled independently of each other, offering a range of benefits for developing and maintaining complex systems.

The benefits are:

Scalability and Flexibility: Microservices architecture offers inherent scalability and flexibility, enabling banks to efficiently adapt to evolving market conditions and customer needs.

Enhanced Fault Isolation: Improved fault isolation in microservices architecture ensures system resilience and uninterrupted service availability, enhancing the customer experience.

Accelerated Development and Deployment: The independence of microservices facilitates parallel development, reducing time-to-market for new features and fostering innovation and adaptability.

Enhanced Security and Compliance: Microservices architecture in banking software addresses essential data privacy and compliance needs, focusing on sensitive user and transaction information. This structure allows for targeted resolution of issues in individual modules, ensuring overall system integrity and adherence to standards such as PCI DSS and GDPR, thereby prioritizing security in fintech startups.

Technology Stack Diversity: Microservices enable the use of diverse technology stacks for each service, leveraging the latest innovations and fostering continuous learning and adaptation.

At the same time, this approach can be challenging because it increases complexity and requires keeping high standards in the development process and cyber security.

Finbox as a case study

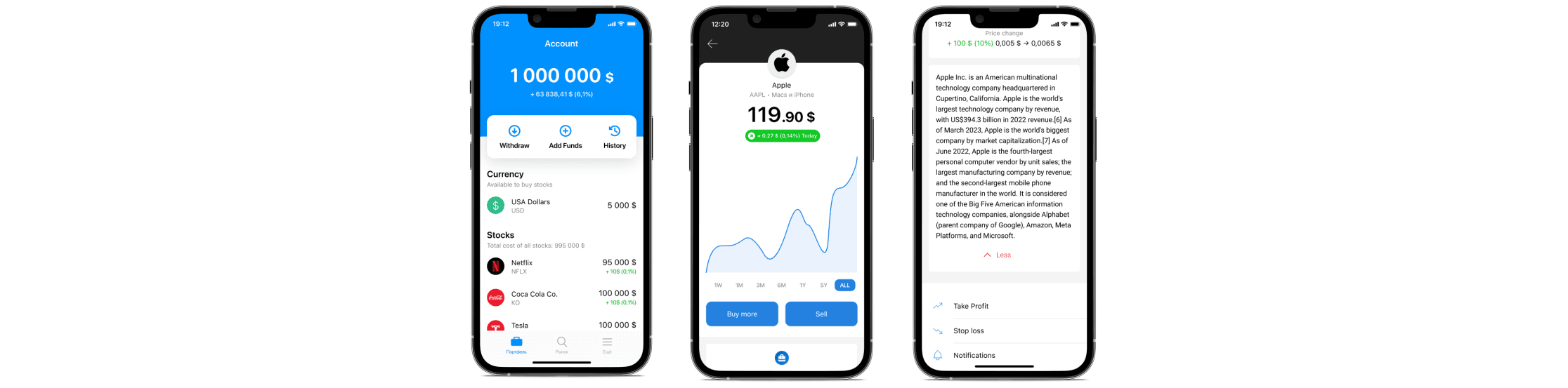

Finbox helps banks and fintechs expand their user base and capitalization by facilitating the launch of additional white-label solutions. One of them is the investing product.

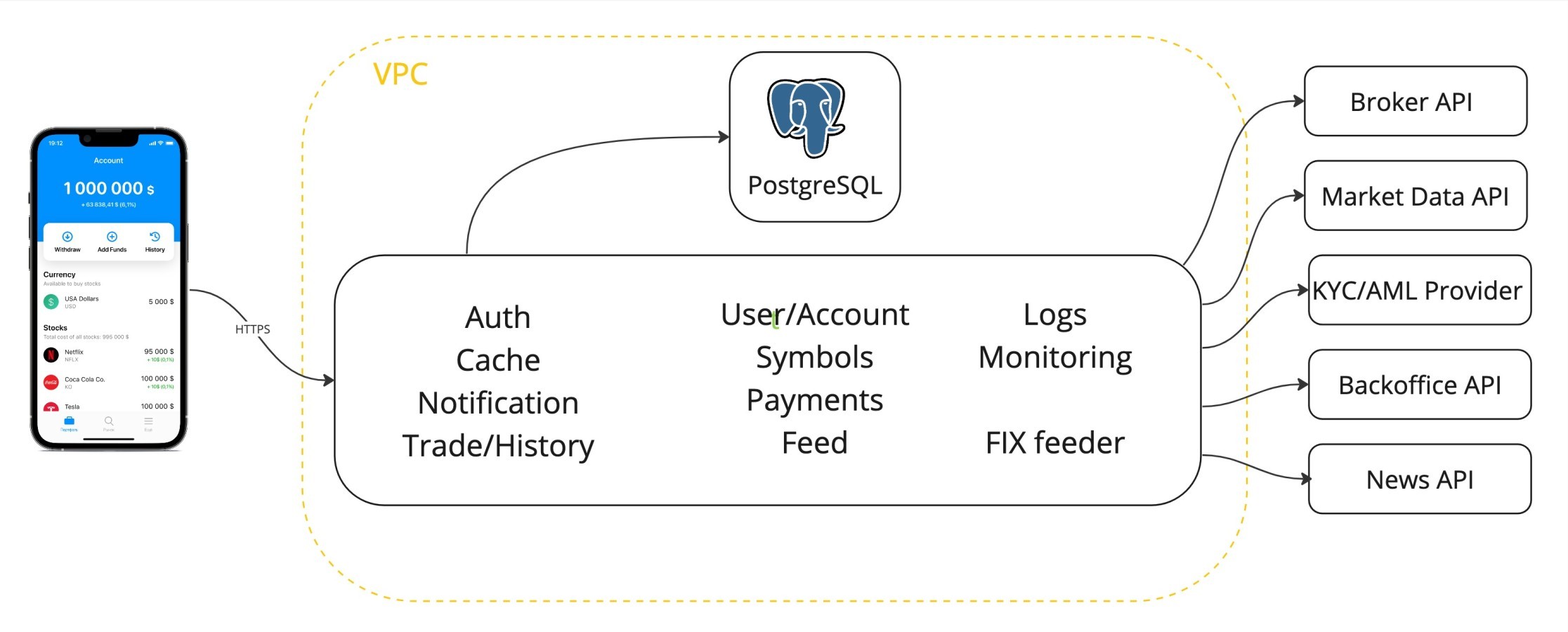

Initially, the backend was designed and built in monolithic architecture and with Java Spring Framework. Everything was implemented in one application with the PostgreSQL database. It was a fast way to develop business logic and have a good pace to reach milestones. However, it caused problems with performance and scalability. Due to a specific use case, the FIX protocol was under high load. We had to create workarounds to prevent application crashes.

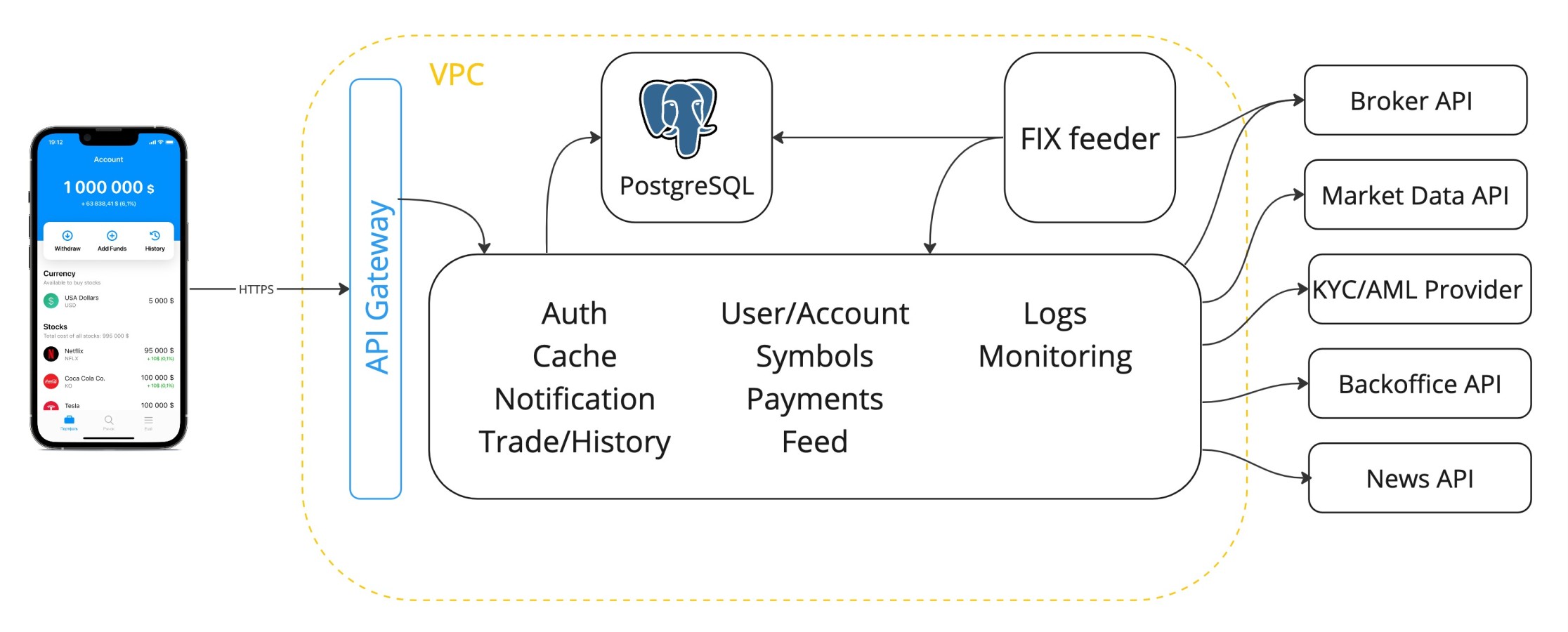

The next iteration was the attempt to avoid problems with the FIX Feeder's high load with many fails and improve the scalability of the API Gateway layer. The challenge for this time was in the core. The codebase was highly coupled, and any change caused crushes in random places. Due to errors in the design and implementation of the architecture, the ability to scale horizontally was not achieved effectively.

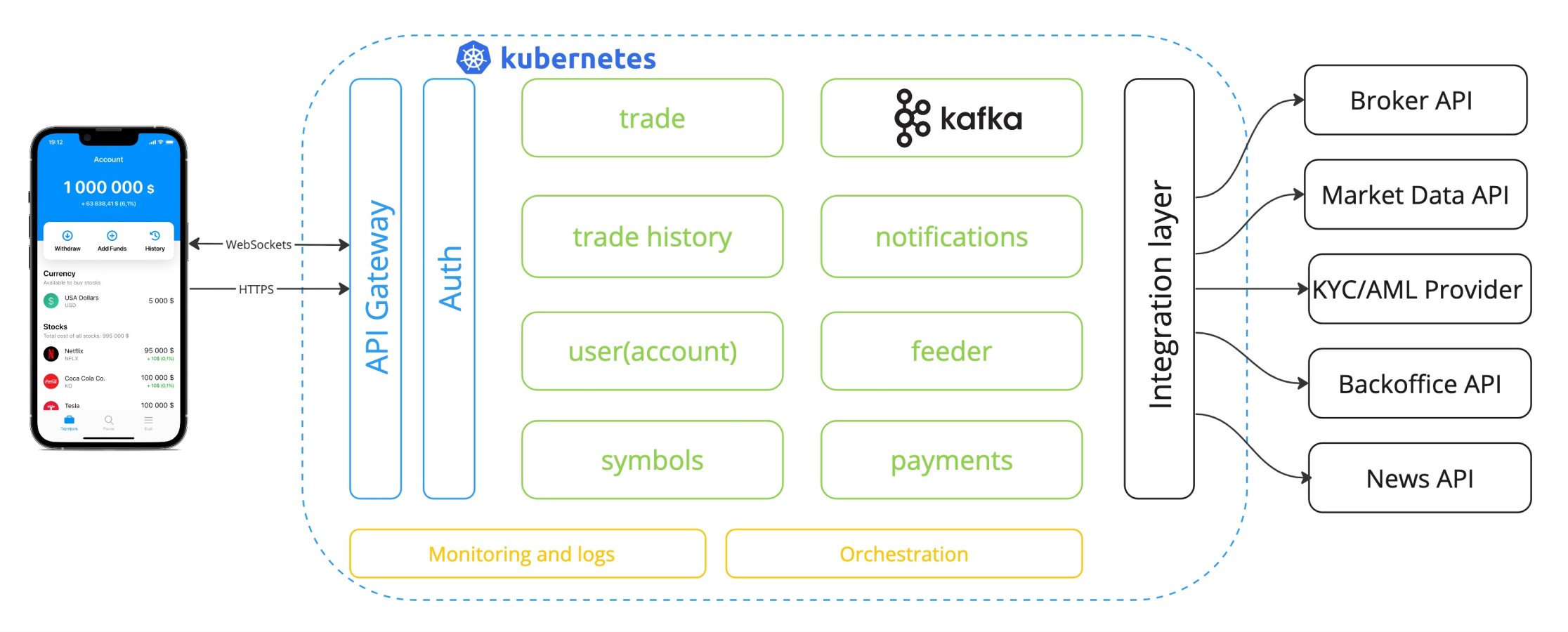

We learned all the lessons during these two phases and decided to move to the fully decoupled microservices architecture with async task processing via Kafka. Now the solution is highly scalable and totally flexible for development and changes on the codebase level and on the architecture level. The Core contains microservices to process the main functionality and each service can be scaled on the fly. Meanwhile, the Periphery manages communication with devices and the 3rd party APIs. We moved from FIX Protocol to HTTPS and WebSockets due to their stability and usability.

Conclusion

In the rapidly evolving landscape of the financial sector, adopting a microservices architecture stands as a pivotal strategy for banking institutions and fintech startups. This approach offers a plethora of advantages including enhanced scalability, improved fault isolation, accelerated development, and heightened customization, all while ensuring adherence to stringent security and compliance standards.

In essence, the integration of microservices architecture is not merely a technological shift but a transformative journey for financial institutions. It is instrumental in achieving operational excellence, enhancing customer satisfaction, and securing a competitive edge in the ever-changing financial ecosystem. Embracing this architectural paradigm is a forward-looking step, positioning organizations at the forefront of fintech innovation and ensuring their sustained growth and success in the digital era.